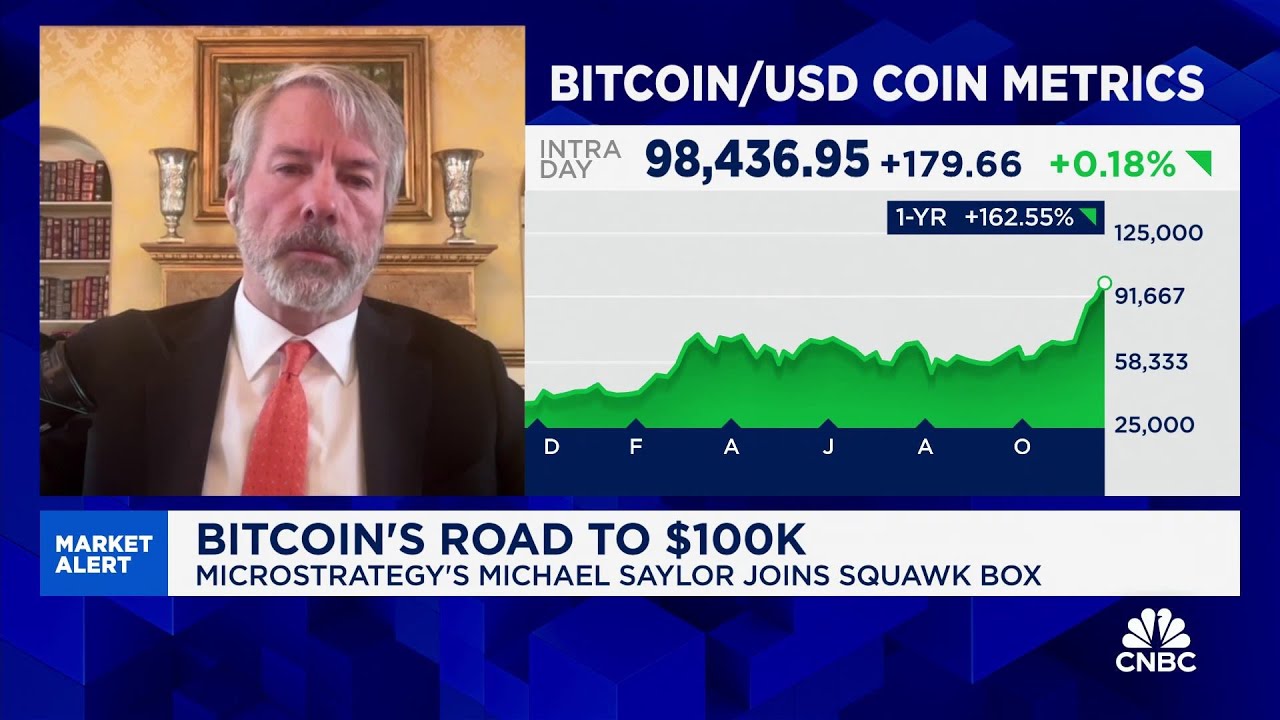

Executive Chairman Michael Saylor has been a formidable figure in the cryptocurrency landscape, particularly with his company’s innovative approach to leveraging Bitcoin. As the world watches Bitcoin’s volatile journey, Saylor’s strategic maneuvers have often come under the spotlight. In this blog post, we’ll delve into the fundamentals of his company’s operations, explore the associated risks, and understand the broader implications of their financial strategies.

Understanding the Core Business Model

Michael Saylor’s company is fundamentally a Bitcoin treasury company, driven by what he calls a “Bitcoin reactor.” With a staggering $35 billion in Bitcoin holdings, the company operates by selling volatility, recycling it back into Bitcoin, and transferring the risk and performance from fixed-income securities to common stock. This strategic model allows the company to deliver returns that are double what Bitcoin alone offers.

The Economics of the BTC Spread

The company’s financial success hinges on generating a spread—the BTC spread. This spread is a function of several premiums: the equity premium, the convert premium, and the Bitcoin premium. For instance, a recent transaction involved an ATM operation that generated a $3 billion BTC gain over five days. This transaction alone could translate to about $36 billion or $150 a share over ten years.

Another strategic move involved a convertible bond that yielded a $2.4 billion gain, which amounts to $125 a share over a decade. These examples underscore the company’s ability to leverage premiums to generate substantial shareholder value.

Addressing the Risks

While the potential gains are significant, critics often point to the inherent risks of such a leveraged Bitcoin position. The primary risk is the existential threat of Bitcoin experiencing an “extension level event” and plummeting to zero. However, Saylor argues that long-term investors and Bitcoin maximalists have already embraced this risk, with an expectation of Bitcoin appreciating by 29% annually for the next 20 years.

The Rationality of Leverage

Despite the concerns, Saylor’s strategy involves borrowing money at a relatively low interest rate of 6% and investing it in Bitcoin, which has historically seen much higher returns. For example, a 3 billion fixed-income raise with an 80% BTC spread could yield $125 a share and $30 billion over ten years. Such strategies highlight the potential profitability and growth trajectory of the company.

The Company’s Remarkable Financial Performance

In recent weeks, the company has generated $5.4 billion in BTC gains, making $500 million a day. Saylor’s confidence in their financial model is palpable as he describes selling dollar bills for $3, sometimes a million times a minute. This kind of profitability and growth rate positions the company as one of the fastest-growing and potentially most profitable in the United States.

The Vision for the Future

Michael Saylor’s approach to Bitcoin and his company’s innovative financial strategies offer a unique perspective on leveraging cryptocurrency in the corporate world. While the associated risks cannot be ignored, the potential rewards for investors who share Saylor’s long-term vision are substantial. As Bitcoin continues to evolve, Saylor’s company may very well serve as a model for how traditional financial strategies can be adapted to the dynamic world of digital currencies.

In conclusion, Michael Saylor’s leadership and strategic vision have positioned his company as a pioneer in the Bitcoin treasury space. By understanding the core principles of their operations and acknowledging the risks, investors and observers alike can gain valuable insights into the future of cryptocurrency investments.